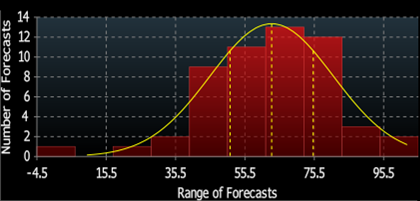

The consensus today is that the global economy, led by developed countries, is heading into recession in the next few quarters. The debate ranges between hard or soft landing. Bloomberg’s recession probability forecast stands at 65% today. To add to this bleak outlook, we have Fannie Mae and Visa, companies with real economy visibility, forecasting an 85% chance of recession.

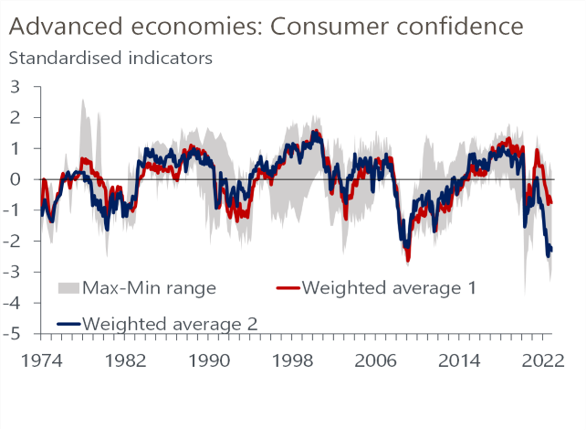

Some of this doom and gloom is based on the past relationship between surveys and hard data. Soft data points to the worst economic environment in half a century, only comparable to the Great Financial Crisis.

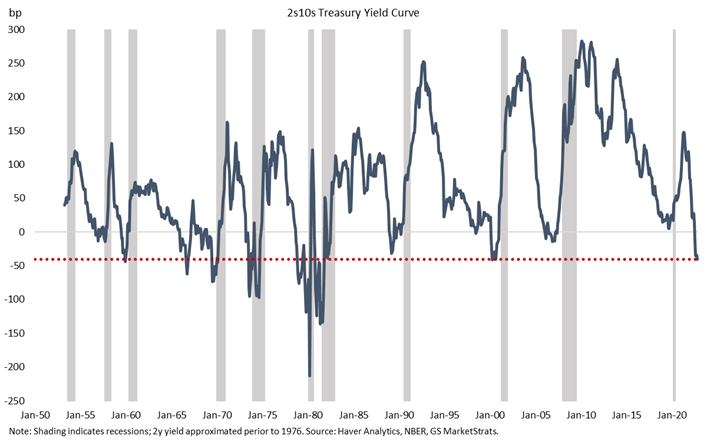

Financial markets are also forecasting an imminent recession when looking at the shape of the yield curve. The spread between 2-year and 10-year US Treasuries is the lowest since the high inflation period of the 1970s.

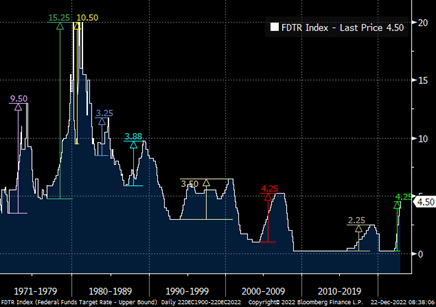

If we could point to only one data point to explain such dreary levels of survey responses and market pricing, it would be the speed and magnitude of the change in short-term nominal rates. The Federal Reserve hiked 425 basis points in nine months. This represents the fastest and largest rate-hiking cycle since the 1970s. The market and economists alike are saying that the current level of interest rates is incompatible with the economy’s structure. Markets believe that this level of rates will invariably cause the economy to contract, inflation to go back to 2% in the short- and long-term, and the Fed to start cutting rates in the second half of 2023.

The conclusion is valid if we accept the assumption that the trends of the 1985-2019 decades are still in effect, and that what we have seen over the past two years was just the effect of transitory impacts of Covid measures.

Having said that, markets are already broadly pricing these assumptions with a reasonably high confidence level. As investors, we must ask ourselves, ‘what if?’ What if there is a deeper reason for the past two years’ economic dynamics? What if we are not living through (only) transitory effects? Then, looking at nominal rates to predict a recession and a turning point for inflation would be misguided. And if so, the US treasury market would have to reprice materially in 2023, causing a structural shift in the global economy and financial markets.

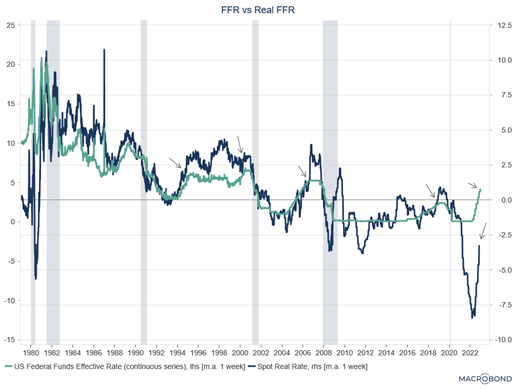

Inflation in the period from 1985 to 2019 averaged 2.6%. This is when we saw the third wave of globalization, increased working-age population, plentiful fossil fuel energy, and the unquestioned Pax Americana. With inflation at such low levels, one would be excused if all its conclusions were based on nominal rates assumptions. But inflation is only low sometimes. From 1950 to 1985, as well as from 2019 to today, inflation averaged 4.5%. When inflation is higher, nominal measures become less important and it is essential to look at real interest rates. Here, we use the Fed Funds Rate deflated by YoY CPI.

Real interest rates tell a very different story. We have seen a sharp increase in real rates since the beginning of 2022, but that move started from a historically low level. Today, real rates are still extremely negative, even after 425 basis points of hikes from the Fed in 2022. The conclusions we draw from looking at this measure are very different from those based on the nominal rate. We see a monetary stance that is not restrictive and, therefore, supportive of growth. With that, we also see the probability of recession at very low levels in the next few quarters, and little reason for the Fed to start cutting rates in the second half of 2023 (let alone the 125 basis points of cuts the market is pricing in between 2H23 and 2H24 – see graph below). This measure helps explain why the labor market is so strong, something that keeps confounding central bankers and analysts alike. It also helps explain why surveys are so pessimistic. In periods of inflation, people tend to have a very pessimistic view of the economy, even when real growth is positive.

We must then ask ourselves. What if real rates are more important for the economy than nominal rates? What if the structural trends of less globalization, a decrease in the working-age population, scarce fossil fuel energy, and a multipolar world materially increase R*? What if the recent weakness in inflation numbers is just a transitory effect as part of a long-term structural inflationary period? What if growth surprises to the upside in 2023, even with the Fed keeping rates above 5%? What if?