In The Changing World Order, Dalio makes the point that history shows us that empires follow a predictable cycle of rising and decline that he termed Big Cycle. The cycle starts at “The Rise” phase when there is strong leadership, education, character, civility, and work ethic development. Innovation is also enhanced by being open to the best thinking in the world. This combination increases productivity, competitiveness, and income. At “The Top”, the country moves from “growing the pie” to “splitting the pie”. While the country enjoys higher standards of living, people get used to doing well and enjoy more leisure time in detriment of hard work. Financial gains come unevenly, and the elites influence the political system to their advantage creating wealth, value, and political gaps. Borrowing grows to make up for the loss in productivity, weakening its financial health. “The Decline” happens when debt is large and there is an economic downturn leaving the country two choices: default or printing new money. Typically, countries opt for new money. The faster the printing occurs, the faster the deflationary gaps close and worrying about inflation begins.

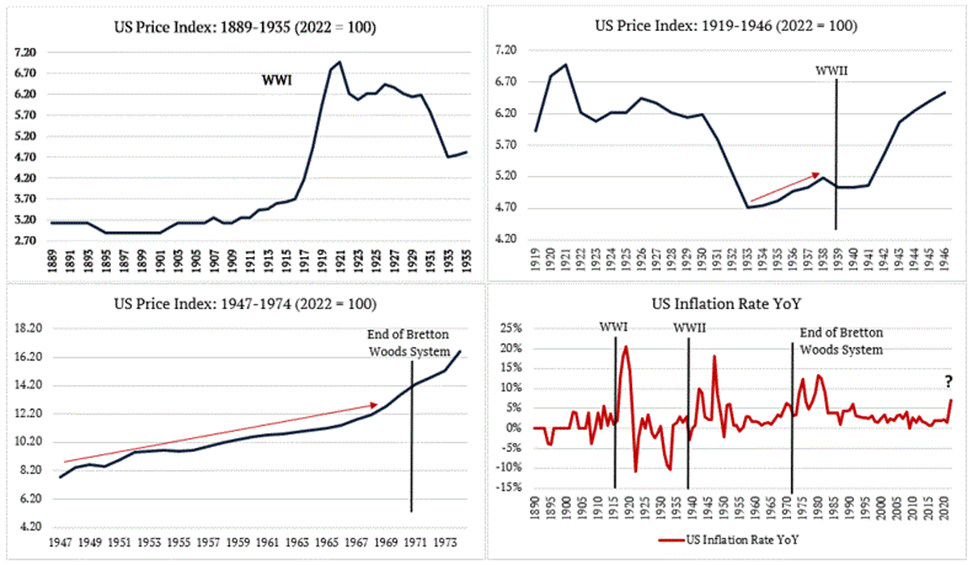

It is clear that major wars are greatly inflationary, and even minor conflicts can interrupt trade, causing disruptions and increasing prices. But what we’re finding out is, inflation actually precedes periods of war or economic warfare.

It should come as no surprise then that the global increase in general prices along with a strong price increase of commodities is leading the world to a new era of conflict. Ukraine and Russia are not just material in the global trade of wheat but now also make up close to 20% of the world corn trade. A prolonged conflict can lead to issues this spring when planting starts causing significant productions shortfalls when harvest comes later this year, causing prices to go higher, increasing the risk of an escalation and conflict. This self-reinforcing process we see between inflation and conflict has a name, reflexivity. [1]

[1]The theory of reflexivity in financial markets was proposed by George Soros. Considered by most as one of the best macro investors in history, delivering an average annualized net return of 33% from 1970 to 2020. His work around the theory of reflexivity first appeared in his 1987 book “The Alchemy of Finance”. Soros’ theory of reflexivity is based around human fallibility—human beings can be wrong in their beliefs about the world and therefore act based on misguided knowledge. Heavily influenced by Karl Popper’s account of the scientific method (Popper was Soros’ tutor at the LSE), Soros argues that when the subject of study involves thinking participants, the scientific method must be changed to account for that fact. When thinking participants try to understand a situation, the independent variable is the situation. And when participants try to make an impact on the situation, the independent variable is participants’ views. Reflexivity occurs when the participant’s view of the world influences the events in the world, and these same events will influence the participants’ view of the world. When reflexivity is in play, it can cause boom/bust processes—self-reinforcement that eventually becomes self-defeating. For a detailed description of reflexivity and the construction of social reality, read “When Functions Collide” at https://www.norburypartners.com/nascimento-decio-when-functions-collide/