Rather than provide a classic “Here are 10 things to watch” list that will more than likely be stale by the time you hear from us next, we’ll share quick views across different markets for 2022.

Equities

At a $3 trillion market cap, Apple is worth more than two years of Brazilian GDP or about equal to the United Kingdom’s GDP in 2020. Put simply, equities (particularly in the US) screen expensive by almost any metric. There are still opportunities to be had here, especially in companies levered to commodities, but with rates rising and Fed QT on the horizon, we are cautious on the asset class.

Commodities

The 2022 Norbury Partners Annual Report will be focused on commodities and a regime shift from an equity-driven market to one driven by commodities, but in brief, we think that decades of underinvestment across the complex, coupled with an increase in demand ex-China will be a boon for commodity prices. Commodities are essential to human life in a way incomparable to other financial assets. There is a strong case to be made that the sector will be a key piece of the geopolitical framework this decade (e.g., Russia, Kazakhstan, China).

Rates

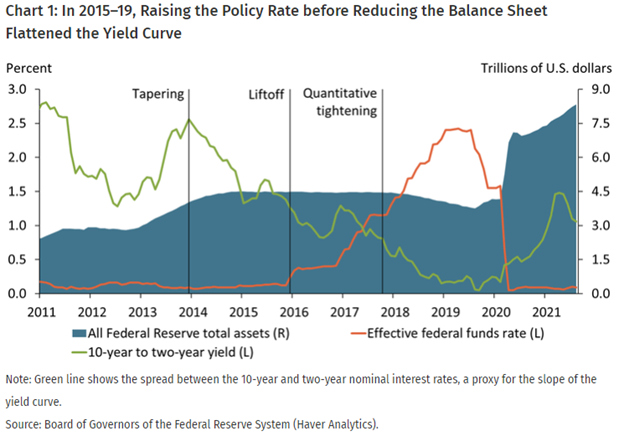

We continue to monitor US interest rates with the view that they should persist moving higher from here and that the curve should steepen. While less clear on the number or pace of rate hikes this year, this paper from the Kansas City Fed (published October 2021) sheds some insight into how the Fed is thinking about policy normalization this time around.

Fewer hikes coupled with a bigger unwind of the balance sheet would in theory not only steepen the yield curve, but also allow banks (who borrow at the short-end and lend at the long-end) to continue making loans to maintain growth in the economy. A steepening yield curve would also help to cap the sharp rise in housing prices we’ve seen in the past year, a key goal for those looking to address wealth and asset inequality in the system.

Currencies

FX volatility screens as the cheapest among all asset classes, and we have been using this to hedge some of our high conviction positions in Equities and Rates.