With so much talk about a recession lately, it is hard not to look for clues in housing numbers. This past week, we had numbers for US housing starts and building permits. While homes only directly account for roughly 5% of GDP, related goods and services can account for nearly 20%. Aside from 2001, the US has never gone through a recession when housing is doing well. Conversely, the US has never emerged from a recession without the help of housing (2009 being the exception with a rebound while housing was stagnant). Fort these reasons, it comes as no surprise that so much attention is given to the release of housing data.

Housing starts record how much new residential construction occurred in the preceding month, while building permits track the issuance of construction permits. The number for both releases is reported in number of units, with the latest number for housing starts and building permits disappointing the Bloomberg median survey at 1.549 million and 1.695 million, respectively. But how disappointing are these numbers, if at all?

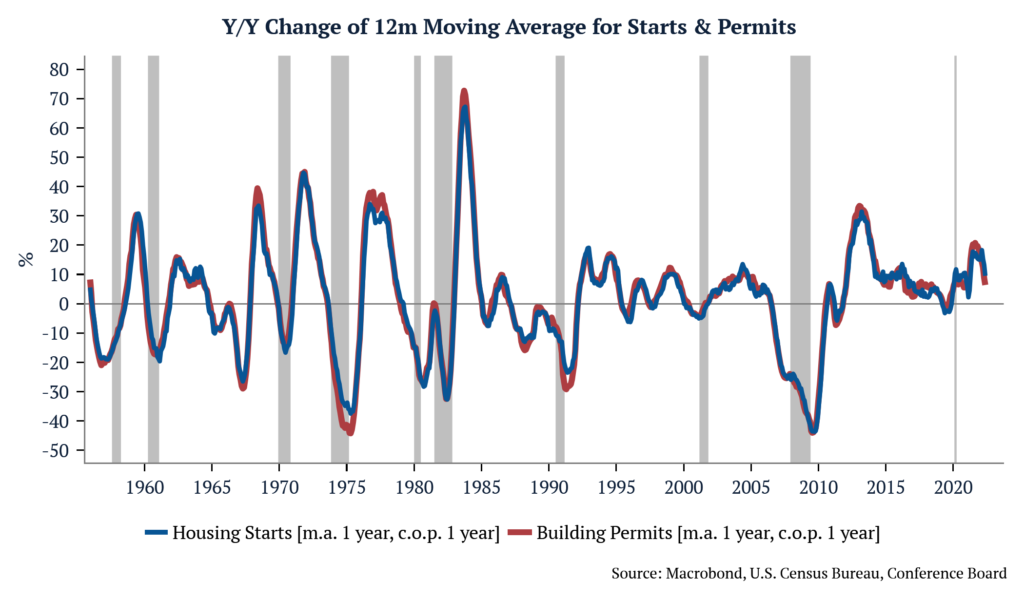

First, let’s look at housing starts. The month-over-month number came in at -14.4%, and comparing the latest release with the same time last year, the number of starts contracted by -3.5%; however, these numbers are very volatile and prone to significant revisions. When looking at the rate of change of the 12-month moving average in May versus the previous month, we encounter only a -0.28% contraction, and when comparing the average with the same period last year, we find a growth of +9.5%. Building permits decreased by -7% MoM and increased +0.2% compared to last year. Using the same 12-month moving average to smooth volatility, the rates of change from the previous month and last year are +0.2% and +6.4%, respectively. We can see some deceleration, but we are still at very healthy levels compared to the past.

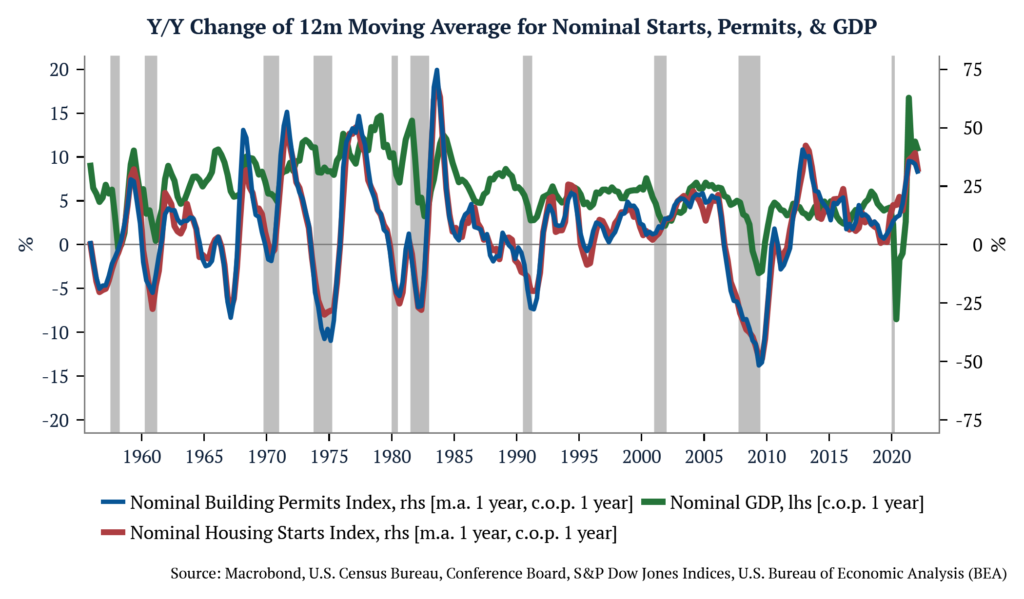

One thing to keep in mind is that looking at housing starts and building permit numbers only gives us an idea of the real component of the economy. But for prices and company earnings, it is Nominal GDP that matters. Therefore, we have constructed a nominal index for housing starts and building permits using the S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index. When looking at that number, we see some deceleration, but in aggregate both starts and permits are still running at very high growth rates.

We cannot draw firm conclusions from a single piece of evidence, but what a closer look at housing starts and building permits shows is that the probability of recession may not be as high as one perceives from reading headlines.