As an investment philosophy, we believe that the best way to deliver above-market returns is to find something cheap, take a position, and hold it for the long term. We tend to avoid market timing and “short-term” investments.

Looking across asset classes, we find that many equities are overpriced on a historic basis by virtually every metric and expect future returns to be much lower than in the past decade, save for a couple of undervalued sectors like energy and materials. When the stock market is on fire, as it has been almost non-stop since 2008, investors ignore companies that specialize in raw materials and other goods. With investors too distracted by their ever-increasing portfolio of technology companies, there was a loss of interest in investing any money in increasing the productive capacity of raw materials, agricultural products, and other hard assets.

In real estate, housing around the world is already too expensive to represent a compelling investment. In the US alone, the S&P Case-Shiller Home Price Index sits a lofty 26 percent above its 2006 peak, with a 17 percent increase year-over-year for the nine US Census divisions. To put this in context, housing prices have been rising more than 5 percent above inflation for the past decade.

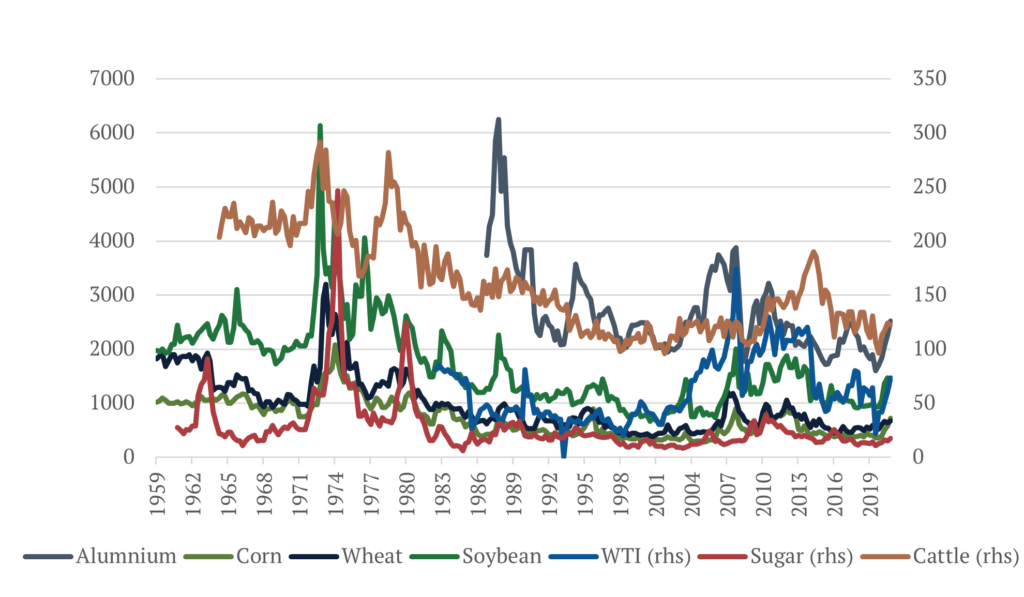

Products like copper and lumber seem expensive but as an asset class, commodities are the cheapest. When you factor in inflation, even after the recent run up in prices, most commodities are trading closer to their historical lows. We will further explore this asset class in detail in future reports.

Bonds have never been this expensive in history and are clearly in a bubble. As we write this letter, 10-year real yields in the United States are at their historical lows of -1.2 percent. With the Fed’s new inflation targeting policy of slightly above 2 percent, real rates could still theoretically go down to somewhere slightly below negative 2 percent, assuming the Fed cannot reduce nominal interest rates meaningfully below zero. However, for that to be true one needs to accept that we are living through some type of global secular stagnation[1] process, from the demand or the supply side.

Herein, we hope to show that such a scenario is extremely unlikely. First, we believe it highly probable that the environment of slower growth and inflation from the past few decades has more to do with a series of temporary “headwinds” arising mostly from consecutive deleveraging processes caused by the fact that almost all recent crises were balance sheet crises, and therefore deflationary. Secondly, we argue that even if we were living through secular stagnation before, we are not anymore. The underlying forces in play for the past few decades began reversing around 2015, and the Covid crisis created a catalyst for an acceleration of these forces.

If you wish to receive a full copy of this report, including our directional views across asset classes, please contact [email protected].

[1] Secular stagnation is defined as a prolonged period of low growth. While prolonged and low are not further specified, many economists define low as an average annual real output growth rate of no more than one to 1.5%, and prolonged as covering at least several business cycles. The term secular does not require stagnation to persist forever.